Ceylon, before independence, was under colonial rule for four centuries. The colonial authorities dominated trade, commerce, and industry as their monopoly. The people of the island were victimized by the traders and moneylenders.

In the wake of new reforms, the State Council of Ceylon approved the instituting of a National Bank in Ceylon based on the recommendations of the Ceylon Banking Commission, appointed in 1934.

This transformational initiative was necessitated by the need to form a national bank to cater to the requirement of our local entrepreneurs, supplementing their financial requirements on a progressive scale to diversify the economy. Since the birth of a bank of our own, a new fire of resurgence was lit up and the people of the nation gathered around it.

Bank of Ceylon, thus thrived upon feeding the financial needs of the people in their day-to-day living, nurturing entrepreneurship, widening the scope of trade, and developing businesses, being the catalyst of growth.

Financial freedom thus created, after four hundred years of foreign dominion, gave an impetus for the nation for the first time, to feel, understand, and experience, the true value of financial autonomy, and thereby stir an aspiration for national independence.

Here we feel one with the touching sentiments, expressed by US President Abraham Lincoln in his famous Gettysburg Address, when we, with all due respect to him, adapt his quote as follows: We are proud to be Bank of Ceylon - Bank of the people, by the people, for the people.

1939 - 1950

Creating financial freedom for the people

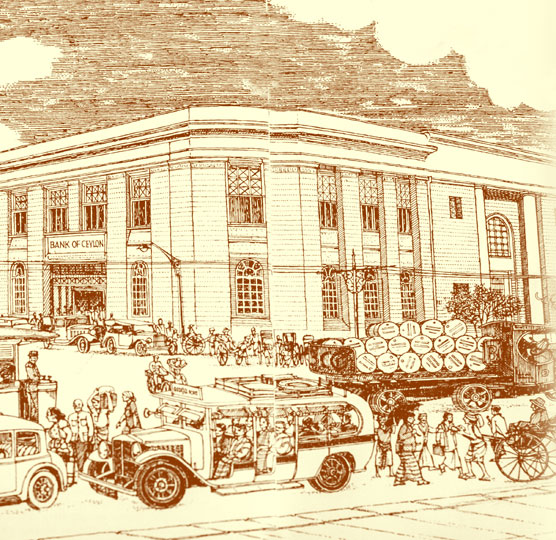

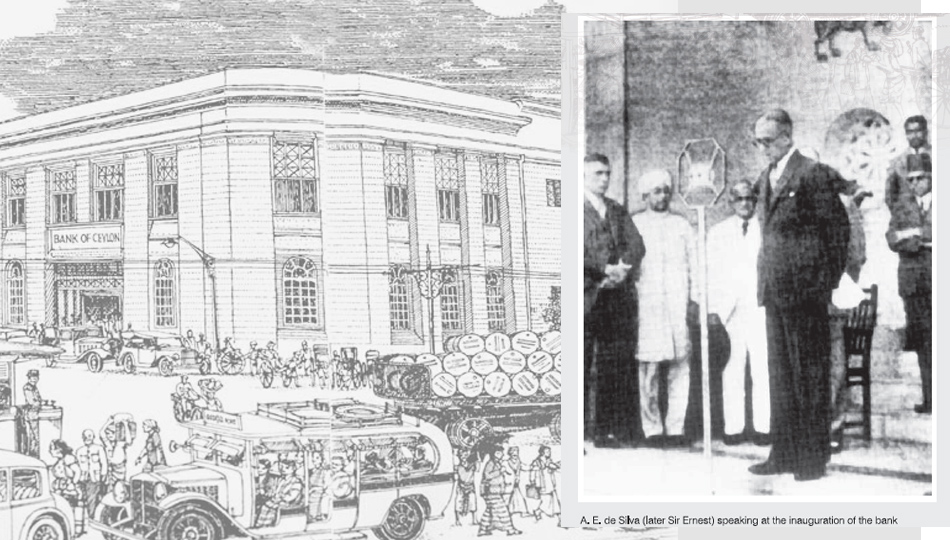

Bank of Ceylon located in the heart of Fort, the commercial metropolis of Colombo, had its doors ceremoniously opened on August 1, 1939, by the Governor of Ceylon, Sir Andrew Caldecott. As the very first domestic bank for the people, up against the strong competition of exchange banks and informal money lenders, its growth was unstoppable.

Seeking out different perspectives, in 1941, the first outstation branch was introduced in Kandy followed by branches in the growing townships of Galle, Jaffna, and Trincomalee. A decade later, taking a broader perspective, and being alert to more opportunities for our customers, Bank of Ceylon established its first offshore presence with its branch in the heart of bustling London in 1949.

1950 – 1975

Reaching rural sector generating agri-productivity

In 1961 Bank of Ceylon was nationalized to facilitate national development strategic efforts. The bank had to fulfil the aspirations of the nation by the prevailing state policies and procedures.

In 1973 Agricultural Service Center Branches were set up Islandwide to enact the Agricultural Productivity Law No 2 of 1972. As an outcome, the branch network expanded tremendously, covering most of the rural areas in Sri Lanka. This era dawned in a new enthusiasm amid the rural agri-communities, as new opportunities generated a new chapter in agricultural productivity, in the island nation.

1975 – 2000

Setting benchmarks throughout our unparalleled journey

A new era in commercial banking in Sri Lanka emerged as an outcome of the open economic policies.

In its wake, the Bank of Ceylon pioneered the introduction of information technology to the commercial banking sector of Sri Lanka.

In 1979, the first Foreign Currency Banking Unit (FCBU) in Sri Lanka was set up by the bank consequent to the liberalization of exchange control regulations.

The Bank set up four regional offices and established the functions of the bank under their purview. By the late ’70s, with island-wide branch coverage, strengthened by greater business volumes, and an increase in the number of overseas branches, the Bank achieved new heights of growth.

Bank of Ceylon enters into other businesses through subsidiary and associate companies set up in addition to commercial banking activities.

In 1981 the bank opened a branch in Malé, the capital of the Republic of Maldives.

In 1982 the first merchant bank in the country - Merchant Bank of Sri Lanka Limited, was inaugurated by the Bank of Ceylon.

In 1987 the new Head Office building is ceremoniously opened by President J R Jayawardene, a 32 storied new Head Office was constructed to house all administrative offices, the International Division, and two separate branches, for the benefit of corporate and personal customers.

In 1989, for the first time in Sri Lanka, the Bank of Ceylon introduced Ceybank Visa Credit Cards in collaboration with VISA International and was geared to introduce many innovative facilities in the new millennium.

In 1995, the bank opened yet another overseas branch, in Chennai, India.

2000 – 2020

Winning the hearts and trust of the people

In 2005, Bank of Ceylon ventured into a turnaround initiative to bring its branch network to a single online system and it was a fruitful historic move for the bank to complete the project in 2009.

In 2008, for the first time in history, the bank listed in the Colombo Stock Exchange, raising funds from the general public amounting to Rs. 4.2 billion via a subordinated rupee debenture of 5 years. It goes to prove the overwhelming trust the people placed in the bank.

In 2010, BOC diversified its operations in the United Kingdom by upgrading its branch in London to a fully-fledged bank operating as a subsidiary of BOC. It is a strategic platform for global banking in attracting more foreign investment to our country.

The bank established its forth overseas branch in Seychelles in 2014.

The bank has been agile and proactive in making adjustments to innovative focus, service differentiation, diversification, cross-selling ability, governance, and risk control. The bank launched an Islamic Banking Unit which operates through an islandwide network, and an Investment Banking Unit aiming at diversifying its portfolio in non-core banking.

The bank successfully raised Rs.5 billion in the second public issue of unsecured subordinated redeemable five-year debentures. In the Rs.10 billion Debenture issue of the Urban Development Authority, BOC acted as the Bankers, Managers, Sponsors, and Registrars to the issue.

Looking at 2020 from a strategic perspective, our key focus during the year was to support both the private and Government sectors through the pandemic crisis.

As Sri Lanka’s premier bank, BOC was also called upon to drive the country’s economic revival, helping businesses to weather the crisis and support their recovery, a role we embraced with passion and commitment while carrying on essential banking and economic activities.

2020 was a year of extraordinary challenges, characterized by a slowdown in economic activities, a persistently low-interest rate regime, and deterioration of portfolio quality. Against this backdrop, BOC was called upon to lead the country’s economic revival through an offering of debt moratoriums and concessionary facilities to customers, capitalizing on opportunities created by the low-interest rate regime, which in turn affected the financial performance of the bank.

2021- 2025

Leading through the crisis into a future of prosperity

Our growth over 86 years has been phenomenal setting benchmarks throughout the journey. We have challenged many a challenge, and this time a pandemic, posing more risk than opportunity which brought down the economic stability affecting the lives of our people. Yet leading from the front, we stand tall, today, as the indomitable leader in the national financial arena. With an LKR 4.3 trillion asset base, we are driven by our vision to be the nation’s preferred bank. With a strong global presence, we are committed to providing customer-centric innovative financial solutions.

It has not been a cakewalk for BOC as the first state-owned bank. A proud record sustaining BOC’s indomitable market-leadership stance from its inception, armed with great skill and proficiency in the financial services arena, has strengthened us to swim against the current global competition, in an open-economy system in Sri Lanka.

We firmly believe that the worst of the pandemic is behind us, and as we walk a new terrain through 2021, into the future, facing unprecedented challenges, we will demonstrate resilience and strength across every dimension.

As the unequivocal leader in the banking sphere, we will inspire the way forward by helping the state navigate through challenging times, being aligned with the country’s national development agenda supporting key sectors and industries, and development projects of national interest, stimulating prosperity and growth.

Harnessing the power of new technology over the years helped us adapt and pivot seamlessly ensuring that we reach out to our customers through digital platforms charting its way in the new economy across the island.

We will continue to upgrade and run with innovation as it happens, absorbing technologies that will strengthen our stance in maintaining our leadership in the financial sector, and sharing our success with our customers, clients, shareholders, and communities as we reach the next level of performance excellence.

We have come a long way and plan to go a long way into the future with you and the many generations to come.